Despite recent temporary easing of US-China tariffs, electronics manufacturers continue to face significant challenges from Section 301 duties. This report examines how additive manufacturing technologies, particularly 3D printed electronics, offer strategic advantages beyond tariff mitigation. Desktop fabrication systems like BotFactory's SV2 printer enable in-house PCB production, accelerating innovation cycles while reducing dependence on offshore suppliers. We analyze the economic impact of tariffs, explore the benefits of additive electronics manufacturing, and evaluate implementation strategies within the context of evolving trade relations.

Section 301's Impact and Recent Developments

Section 301 tariffs on Chinese imports have fundamentally reshaped electronics manufacturing since their 2018 implementation. These duties, targeting intellectual property concerns and technology transfer issues, have imposed additional costs of 25% on critical electronic components including PCBs and semiconductors. Despite administration changes, these tariffs have largely persisted, with 2024-2025 reviews even expanding duties on strategic high-tech items to rates between 25% and 50%.

In a significant development on May 12, 2025, following negotiations in Geneva, the US and China announced a temporary 90-day reduction of some recently implemented tariffs. The US suspended 24% of additional duties imposed in April 2025, bringing the baseline US tariff on affected goods to 30% (excluding pre-existing tariffs).

While this offers short-term relief, the underlying Section 301 tariffs remain largely intact. Manufacturers still face substantial cost pressures, with PCBs seeing 25-45% higher component costs, microcontrollers experiencing 15-40% price increases, and connectors facing 20-40% price impacts. These direct costs translate to an average 3-5% reduction in gross margins across affected manufacturing sectors, with estimates suggesting 60-85% of tariff costs eventually pass through to customers.

| Component Category | Typical Tariff Rate | Cost Impact | Current Status |

| PCBs | 25% | 25-45% higher costs ($0.85-1.40/sq in) | 2/4-layer FR4 boards temporarily excluded until Oct 2025 |

| Semiconductors | 25-50% | 15-40% price increases (STM32/ESP32 most affected) | Active; CHIPS Act exclusions pending review |

| Connectors/Passives | 25% | 20-40% price impact ($0.03-0.18 per unit) | Active; no exclusions planned through 2025 |

| Display Materials | 25% | 30-55% increased expenses ($2-6 per LCD module) | Active; temporary exclusion for medical displays only |

Supply Chain Disruptions and Strategic Responses

The current operational landscape for manufacturers is fraught with a number of immediate challenges. 42.7% of manufacturers are facing microcontroller shortages, particularly in the STM32 and ESP32 series. Additionally, the volatility in PCB material prices has resulted in a 25-45% increase, with costs now ranging from $0.85 to $1.40 per square inch. Logistical issues are also a concern, with port delays averaging 15.6 days through the Los Angeles/Long Beach ports, and an additional 7.3 days required for country-of-origin verification.

In response to these tactical challenges, manufacturers have had to implement a number of measures. These include increasing inventory levels by 35-45% through strategic stockpiling, purchasing semiconductors on the spot market at a 22% premium to maintain production, and incurring a 38% cost increase from expedited air freight logistics. Manufacturers are also seeking temporary exclusions under the May 2025 tariff suspension in an effort to mitigate the financial impact.

Tariff Impact Assessment

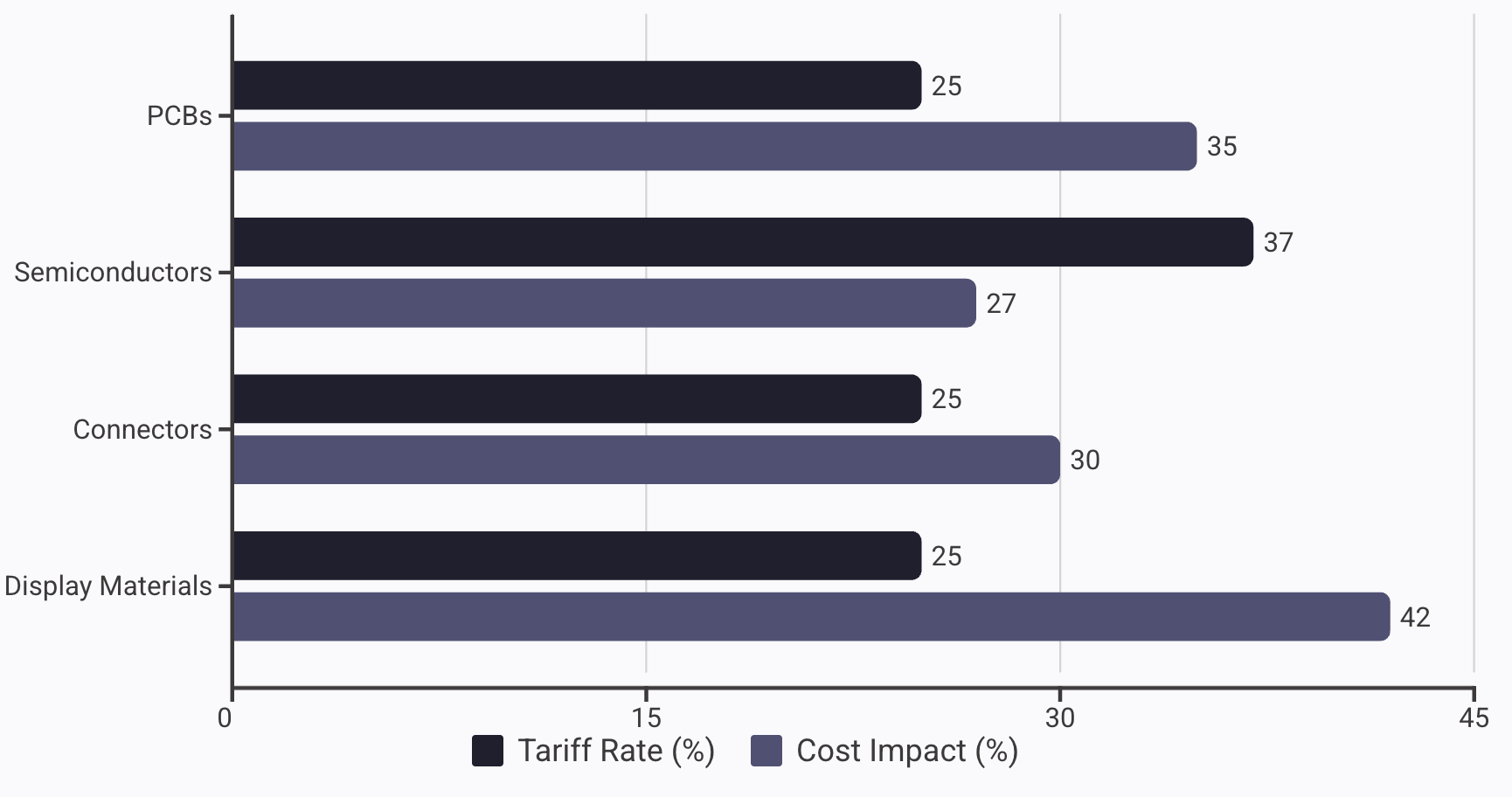

.The horizontal bar chart illustrates the disproportionate relationship between tariff rates and actual cost impacts across four key component categories. While semiconductors face the highest tariff rate at 37%, display materials experience the most severe cost impact at 42% despite a lower 25% tariff rate, indicating additional supply chain factors magnifying the effect. PCBs and connectors both face 25% tariffs, yet their cost impacts differ significantly (35% vs 30%), demonstrating how tariff effects cascade differently through the supply chain based on component complexity and sourcing alternatives. This data underscores why manufacturers are prioritizing display materials and PCBs in their tariff mitigation strategies.

Strategic Manufacturing Shifts

- US PCB manufacturing expansion (4.3 million sq ft under development)

- Mexico nearshoring reducing tariff exposure by 31%

- "China+1" diversification with 58% of redirected investment to Vietnam, Malaysia and Thailand

- 72,500 new electronics sector jobs created since 2023 (39.2% of reshored positions)

Long-Term Innovation Strategies

- $8.4B investment in domestic connector and passive component production

- 3D printed circuit boards to avoid $0.85-1.40/sq in tariff-related costs

- Regional manufacturing hubs reducing supply chain vulnerability by 47%

- Leveraging $52B CHIPS Act funding against 15-40% semiconductor price increases

3D Printed Electronics: A Tariff Mitigation Strategy

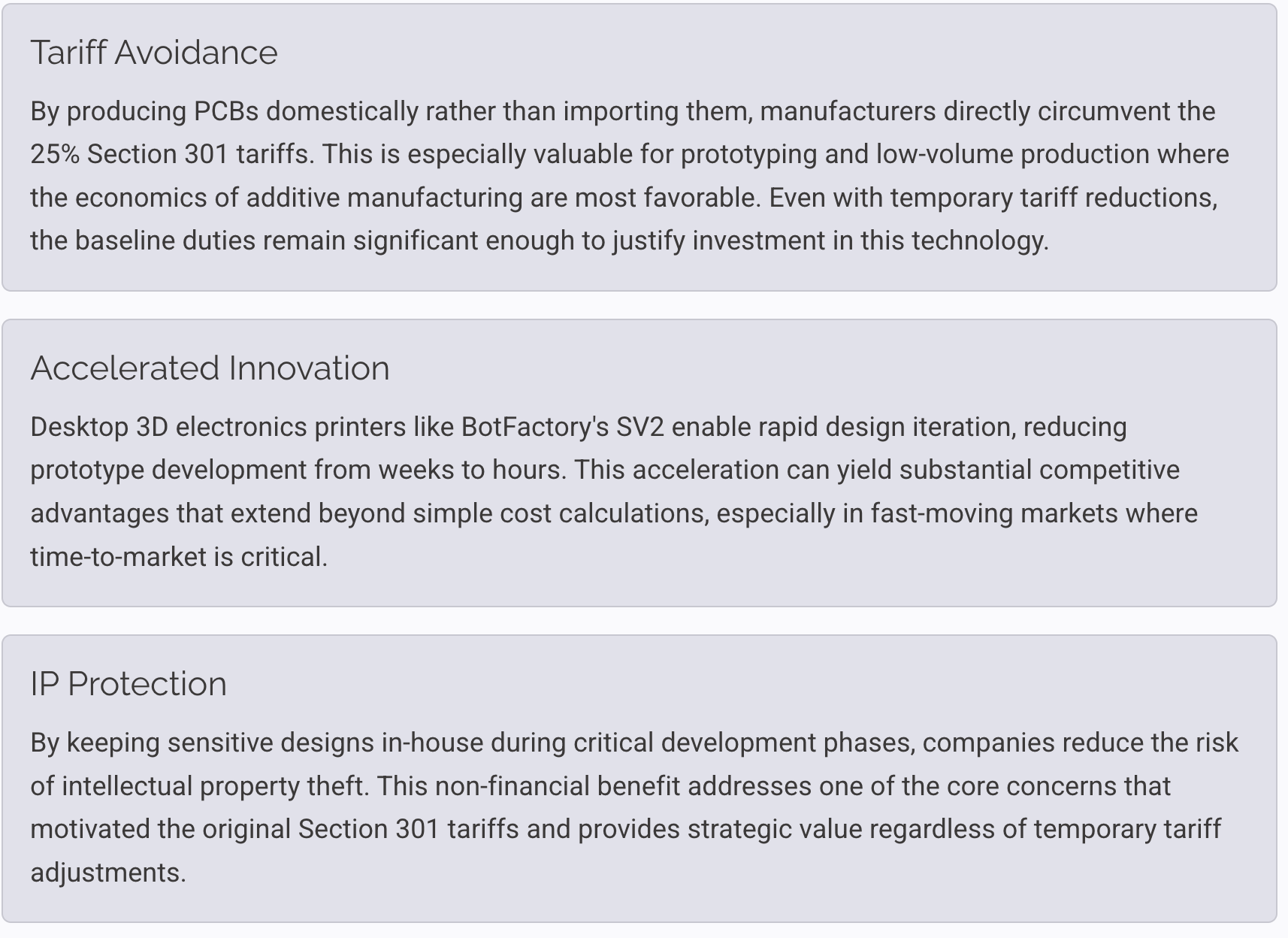

Additive manufacturing technologies, particularly 3D printed electronics, offer a compelling approach to mitigating tariff challenges. By enabling in-house fabrication of PCBs and other electronic components, these systems allow manufacturers to avoid direct import duties while gaining additional strategic advantages.

Key Benefits of 3D Printed Electronics

Current Technology Landscape

Desktop systems integrate multiple processes—including circuit printing, paste dispensing, and component placement—into accessible platforms that lower the barrier to entry for this technology. While current limitations include scalability constraints for high-volume production and conductivity trade-offs compared to traditional copper, the technology continues to advance rapidly, making it increasingly viable for a wider range of applications.

Effective Implementation Approach

Effective adoption of 3D printed electronics requires a comprehensive implementation strategy that addresses both technological and organizational factors. A hybrid manufacturing approach is recommended, combining additive techniques with traditional processes based on volume and performance requirements. This allows companies to maximize tariff avoidance benefits while maintaining quality and scalability.

Companies should focus initially on prototyping, small-batch production, and customized electronics applications where additive manufacturing excels. BotFactory's desktop fabrication systems provide the ideal entry point, offering an accessible platform for organizations transitioning to in-house electronics production without requiring extensive capital investment or specialized expertise. As technology advances, gradual expansion to higher-volume production becomes feasible.

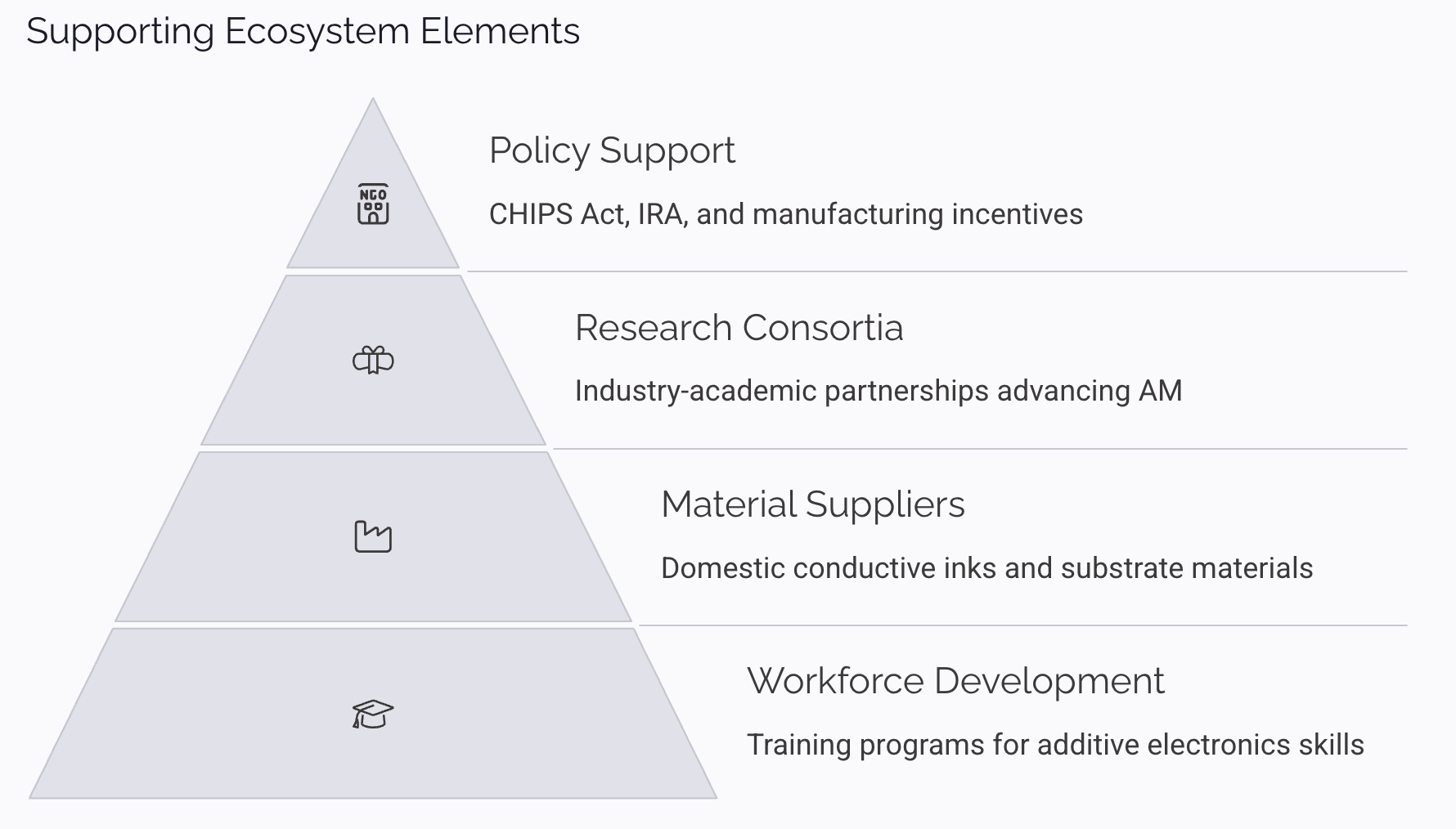

Ecosystem Collaboration and Long-Term Benefits

Success ultimately depends on robust ecosystem support. Government policies like the CHIPS Act provide incentives for domestic production capabilities. Research consortia drive technological advances in materials and processes. BotFactory serves as a crucial technology enabler within this ecosystem, providing not only hardware solutions but also technical expertise, design guidance, and workflow optimization services to facilitate successful implementation. Their collaboration with domestic material suppliers ensures reliable access to compatible conductive inks and substrates, while their training programs help build the necessary skills for operating and optimizing additive systems.

Strategic Value Beyond Tariff Mitigation

Despite the recent temporary easing of some tariffs, the fundamental rationale for exploring additive electronics manufacturing remains strong. BotFactory's desktop fabrication systems offer an accessible entry point for organizations seeking both immediate tariff relief and long-term strategic advantages. Their technology provides not only tariff mitigation but builds resilience against trade policy uncertainty while accelerating innovation. As BotFactory continues to advance their technology platforms, their role in reshaping electronics manufacturing will likely grow, regardless of the specific tariff environment.