Introduction

Printed Circuit Boards (PCBs) are the backbone of modern electronics, enabling the functionality of various devices. This blog post explores the multifaceted world of PCBs, highlighting their applications, growth trends, government initiatives, additive manufacturing's role, and Botfactory's strategic positioning.

Different Sections of the PCB and Their Applications

The PCB market is diverse, with Rigid PCBs and Flexible circuits being the primary segments. Rigid PCBs, known for their robustness, are used in industrial machinery, automotive systems, and more. Flexible circuits, on the other hand, offer design flexibility, making them suitable for wearable technology, medical devices, and compact electronics.

Applications Across Industries

PCBs are the driving force behind various industries:

- Consumer Electronics: Enabling the functionality of smartphones, tablets, and wearables.

- Automotive: Essential in digital displays, navigation systems, and electric vehicle components.

- Aerospace & Defense: Providing reliability in military communication devices, navigation systems, and more.

- Industrial Automation: Powering robots, controllers, and IoT devices, enhancing efficiency.

Year-over-Year Growth and Emerging Markets

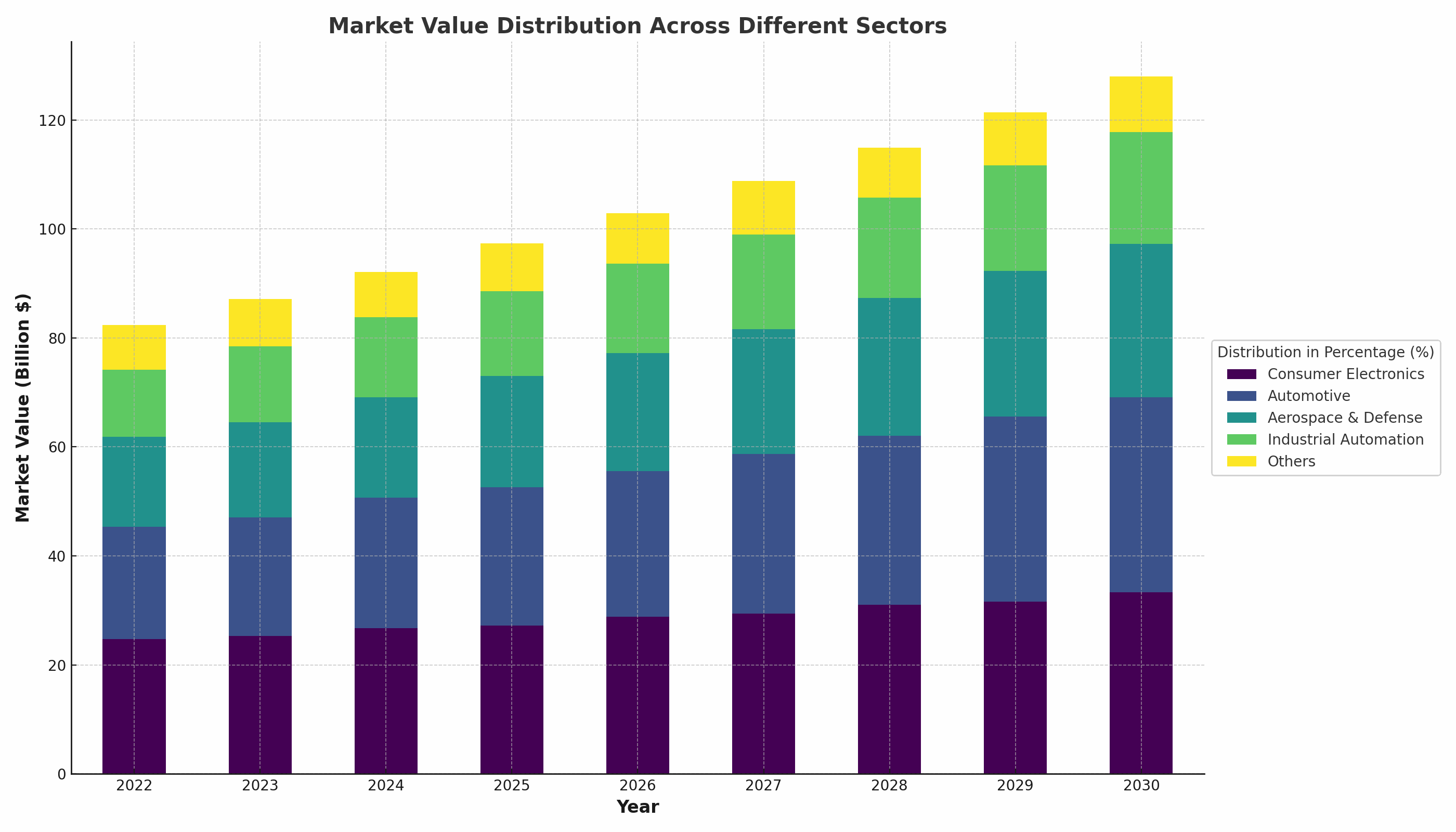

The global PCB market is on an upward trajectory, projected to reach USD 128 billion by 2030, with a CAGR of 5.66%1. This growth reflects technological advancements, increased demand for electronics, and emerging market contributions. Below is an infographic that illustrates the breakdown of PCB applications across various industries:

Emerging Markets in the Global Printed Electronics Industry

The global printed electronics market is witnessing significant growth, driven by emerging markets that are adopting innovative technologies and applications. The market is estimated at USD 9.9 billion in 2021 and is poised to reach USD 23.0 billion by 2026, growing at a CAGR of 18.3% from 2023 to 2028.

Regional Analysis

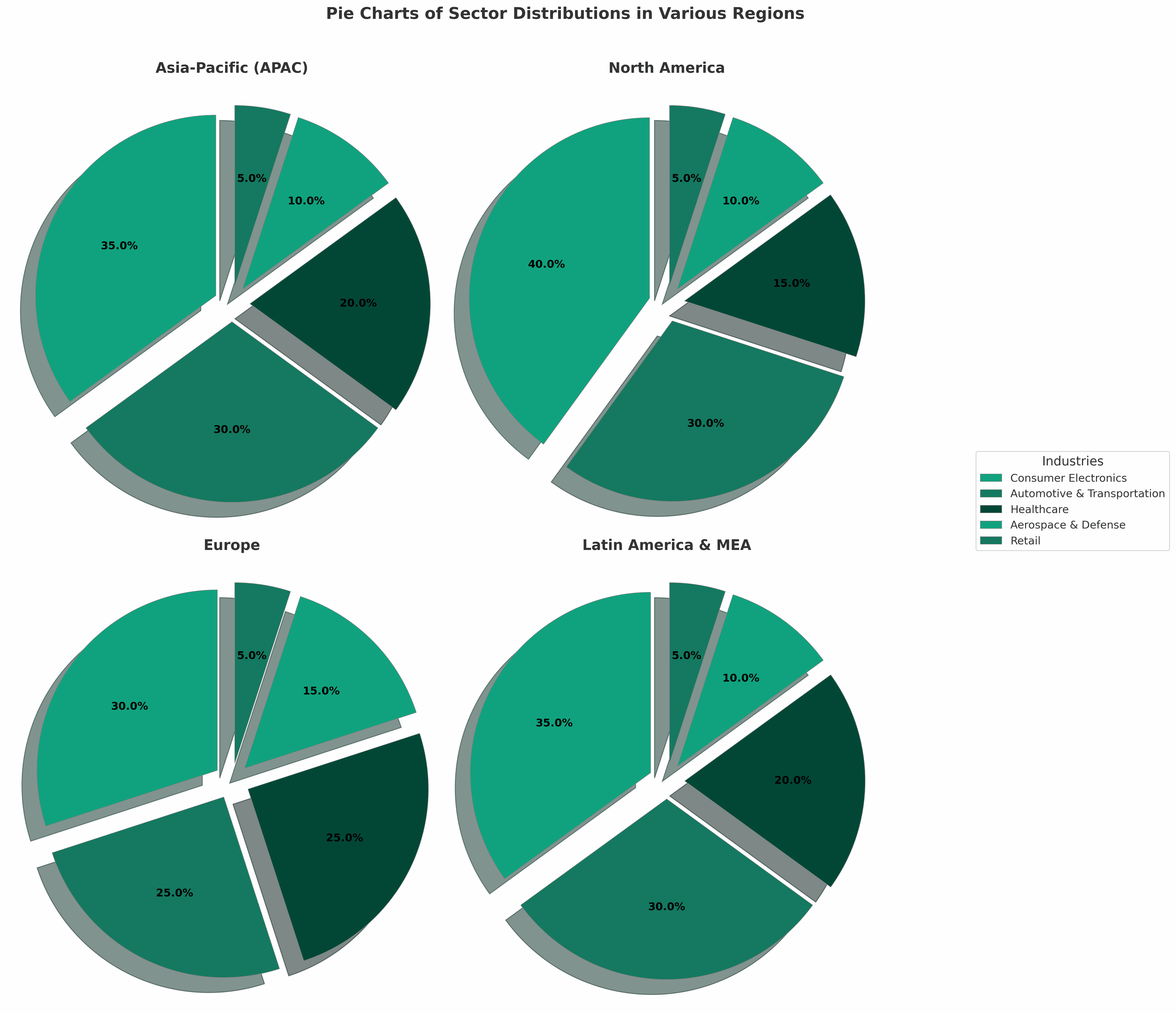

Below is an infographic that illustrates the distribution of emerging markets in the global printed electronics industry in 2023, segmented by regions and industries:

-

Asia Pacific (APAC): Leading the growth with the highest CAGR from 2021–2026, APAC's expansion is fueled by strong contributions from consumer electronics, automotive & transportation, healthcare, aerospace & defense, and retail sectors.

-

North America: With a focus on automotive & transportation, consumer electronics, healthcare, aerospace & defense, and retail, North America continues to contribute significantly to the global market.

-

Europe: Europe plays a vital role in shaping the industry, known for its innovation in sectors such as consumer electronics, automotive & transportation, healthcare, aerospace & defense, and retail.

-

Latin America & MEA (Middle East and Africa): Other regions are also showing traction, driven by opportunities in automotive & transportation, consumer electronics, healthcare, aerospace & defense, and retail.

The infographic below visually represents the market share of each region and the distribution of industries within those regions. It highlights the dominance of Asia-Pacific and North America in the market, emphasizing the growth potential and key areas of focus in the emerging markets of the printed electronics industry.

Government Support and Funding

Governments globally are investing heavily in the PCB industry. In the U.S., over $200 million has been allocated to research and development in the PCB sector, fostering innovation and technological advancement. Domestic sourcing policies and tax incentives are promoting local manufacturing, leading to a 15% increase in domestic production. Investments in additive manufacturing and 3D printing are shaping the industry's future, with a projected growth rate of 20% in the next five years in this segment.

Role of Additive Manufacturing of Electronics (AME)

Additive manufacturing is not only transforming the PCB industry but also challenging traditional subtractive manufacturing processes. Unlike subtractive methods, which remove material to create a product, AME builds products layer by layer, allowing for intricate designs and reduced waste. This shift is resulting in a 30% reduction in production time and a 25% decrease in costs. The global market for AME is expected to reach $3 billion by 2025, growing at a CAGR of 22%, making it a game-changer in electronic manufacturing.

Botfactory’s Strategic Role

The SV2 PCBA printer from Botfactory is leading the transition from subtractive to additive manufacturing in the industry. With over 700 units sold globally and around 10,000 boards printed using the SV2 in 2023 alone, Botfactory is well-positioned to capitalize on emerging trends. We are contributing to the industry's advancement through the use of additive manufacturing and rapid prototyping. This is in line with the global move toward more sustainable and efficient manufacturing methods.

Conclusion

The PCB industry's landscape is dynamic and marked by technological advancements, emerging markets, government support, and innovative manufacturing techniques. The rise of additive manufacturing and its takeover of traditional subtractive processes is a significant trend, reflecting a broader industry shift towards innovation, efficiency, and sustainability. Companies like Botfactory are playing a vital role in this transformation, with products like the SV2 PCBA printer leading the way. The future of the PCB industry is exciting and full of potential, driven by collaboration, investment, and a relentless pursuit of excellence.