2025 marks a transformative period for the U.S. electronics industry as complex tariff policies reshape the PCB manufacturing landscape. While rising costs and supply chain disruptions pose significant challenges, opportunities for domestic production revival, supply chain diversification, and technological innovation are emerging. This analysis examines the impacts of Section 301 tariffs against Chinese imports, new broad ad valorem duties, and reciprocal tariffs, offering strategic insights for industry professionals navigating this evolving environment.

The Shifting Landscape of PCB Production

| Mounting Challenges | Emerging Opportunities |

|

U.S. PCB manufacturers confront an array of pressures extending well beyond direct tariff costs. Escalating prices for critical raw materials and specialized manufacturing equipment have further compressed profit margins for domestic producers. Policy volatility creates a climate of uncertainty that significantly hampers long-term investment planning, with frequent changes in tariff rates, suddenly expiring exclusions, and new trade investigations emerging with minimal advance notice. Administrative complexities further exacerbate these challenges, necessitating meticulous tracking of Harmonized Tariff Schedule codes, rigorous compliance with Rules of Origin requirements, and navigation of increasingly complex exclusion processes. The recent revocation of the de minimis exemption for Chinese goods introduces additional costs even for small-value component imports, disproportionately affecting smaller manufacturers. |

Despite these formidable headwinds, promising avenues for growth are materializing across the industry. Supply chain diversification has accelerated dramatically, with forward-thinking companies implementing comprehensive "China+N" strategies and establishing alternative manufacturing hubs throughout Southeast Asia and Mexico. This strategic recalibration creates substantial opportunities for domestic PCB manufacturers, particularly in high-value segments such as rapid prototyping, New Product Introductions (NPIs), and specialized low-to-mid-volume production runs. Government initiatives have emerged as catalysts for transformation, with the CHIPS and Science Act allocating $52.7 billion toward revitalizing domestic electronics manufacturing capacity. This includes a targeted $2 billion investment specifically earmarked for PCB and critical electronic component manufacturers, announced in January 2025—a decisive step toward rebuilding domestic capabilities in this essential sector. |

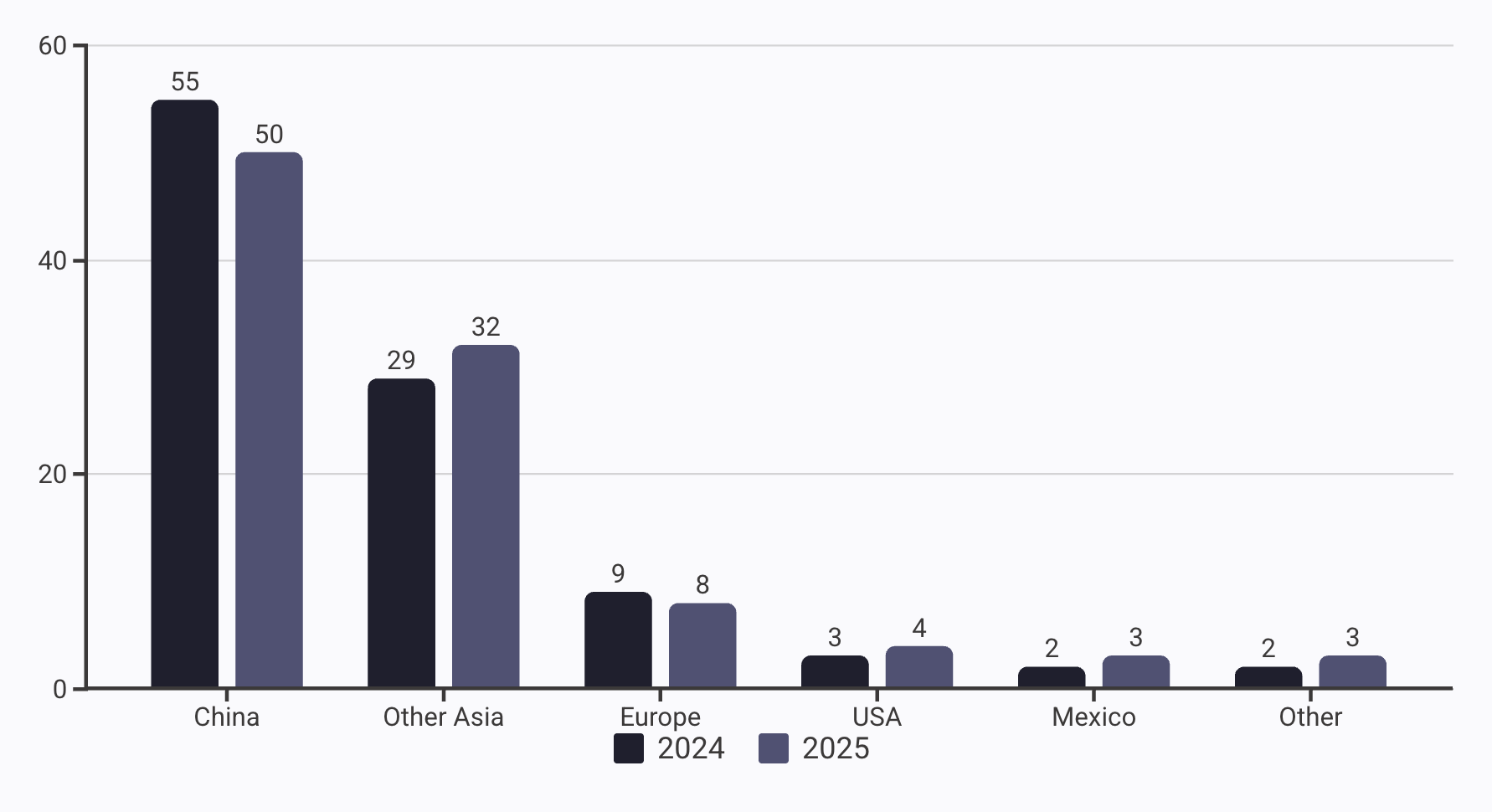

The chart illustrates the year-over-year shift in global PCB production, highlighting China's declining share (from 55% to 50%) while the USA, Mexico, and Other Asian countries have gained ground. This redistribution reflects the impact of tariffs and strategic supply chain diversification efforts.

Navigating the New Competitive Landscape

While tariffs erode price competitiveness for U.S.-made electronics in global markets, they also present opportunities for differentiation. Domestic manufacturers can leverage proximity advantages, offering faster turnaround times, reduced shipping complexities, and more agile responses to customer needs—particularly valuable for NPIs and custom solutions.

Strategic Adaptation and Future Outlook

Key Tariff Effects

The 2025 tariff increases—reaching 35% on Chinese electronic components and 25% on PCBs—have dramatically reshaped the U.S. electronics manufacturing landscape. Domestic manufacturers report a 22-28% increase in production costs, with semiconductor components seeing the steepest price jumps.

These added expenses have compressed profit margins by an average of 15.3% industry-wide, forcing manufacturers to implement strategic price increases of 12-18% on finished products. The resulting market realignment has favored larger manufacturers with diversified supply chains, while smaller producers with less negotiating leverage face greater adaptation challenges.

- Raw material costs up 32% for copper and specialty laminates

- Component lead times extended from 8-12 weeks to 14-20 weeks

- 18% shift in market share from import-dependent to domestically-sourced manufacturers

- 42% of manufacturers accelerating automation investments to offset higher labor costs

Reshoring and Manufacturing Evolution

To counter the 35% tariff impact, leading manufacturers like CircuitTech and Nexus Electronics have invested over $450 million in new U.S. facilities, focusing on high-mix, low-volume production that leverages proximity advantages. These facilities employ 30-40% fewer workers than comparable Chinese operations while achieving 25% higher throughput through extensive automation.

Supply Chain Restructuring

The disruption of established supply networks has driven a 58% increase in Mexico-based PCB production capacity and a 63% rise in component inventory holdings among U.S. manufacturers. The average electronics company now maintains 4.2 months of critical components versus 1.8 months pre-tariff, increasing working capital requirements by approximately $3.5 million for mid-sized operations.

Competitive Positioning and Future Trajectory

While domestic PCB manufacturers have captured an additional 5% market share, their average price premium of 18-24% limits growth in consumer electronics. The industry's long-term viability hinges on the $2 billion CHIPS Act allocation for PCB manufacturing and whether the productivity gains from advanced manufacturing technologies—currently improving output-per-worker metrics by 22% annually—can eventually neutralize the 35-40% labor cost differential with Asian competitors.